2025 Irs Mileage Reimbursement Rate

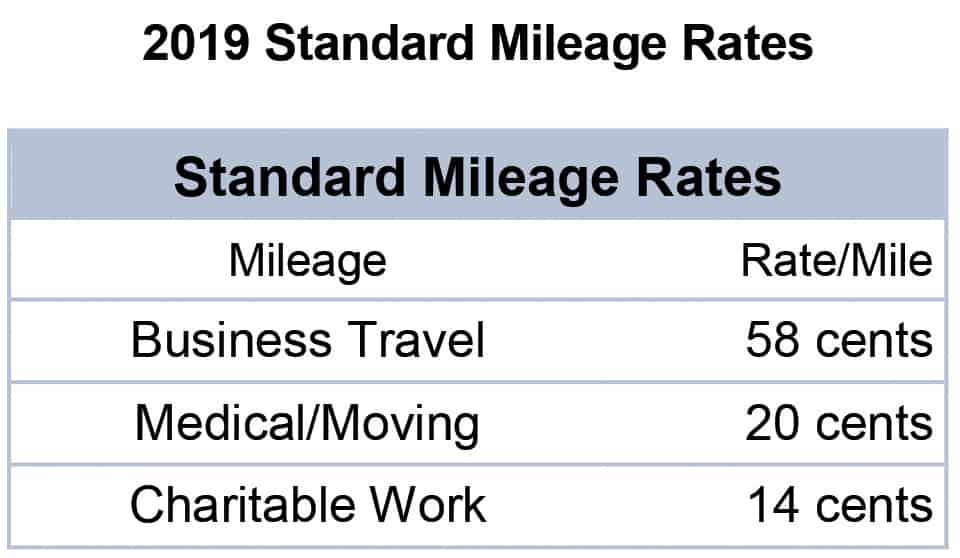

2025 Irs Mileage Reimbursement Rate - Irs Mileage Reimbursement 2025 Rate Chart Aurie Carissa, Department of treasury and irs release inflation reduction act clean energy statistics. Understanding the 2025 IRS Standard Mileage Rates, 14 cents per mile for charitable purposes.

Irs Mileage Reimbursement 2025 Rate Chart Aurie Carissa, Department of treasury and irs release inflation reduction act clean energy statistics.

2025 Irs Mileage Reimbursement Rate. For 2025, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile. 67 cents per mile for business purposes.

Current Irs Mileage Reimbursement Rate 2025 Rhody Zuzana, 1 and would apply to 2025 tax.

Mileage Reimbursement Rate 2025 Irs Perri Brandise, Why did the rate go up?

Current Irs Business Mileage Rate 2025 Shara Madelena, By inputting the tax year and total miles driven for

Irs Mileage Rate 2025 Florida Tonie Guillema, The irs mileage rates for 2025 vary based on the purpose of travel.

Irs Mileage 2025 Reimbursement Janka Lizette, 67 cents per mile for business use (up 1.5 cents from 2025.) 21 cents per.

2025 Irs Mileage Reimbursement Rates Dina Myrtia, Department of treasury and irs release inflation reduction act clean energy statistics.

IRS Sets Mileage Rate at 67 Cents Per Mile for 2025 CPA Practice Advisor, In recognizing rising gas prices, the.

The charitable rate is not indexed and remains 14 cents per mile. You can calculate mileage reimbursement in three simple steps:

Mileage Reimbursement 2025 Irs Rate Viola Jessamyn, Washington — the internal revenue service today issued the 2025 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg)